This article is part of the Fixed Assets Module training. Click here for more information on the Fixed Assets Module.

Asset Classes serve as templates that are used in the creation of Assets. Additionally, Assets can be sorted or organized by Asset Class. Asset Classes can be created manually, or imported through the Setup Assistant. Assigning an Asset Class is required during the creation of an Asset.

- Note: While an Asset Class is required to be assigned to an Asset, once selected, the settings and values can be updated as needed.

An Asset Class contains two sections: General and Accounts.

General

1) Name - Enter the Name of the Asset Class as it will be displayed in R365

2) Depreciation Method - Set the method in which the Asset will be Depreciated. Click here for full Depreciation Method Definitions and Examples. Options include:

- Straight Line

- None

3) Convention - Determine when the depreciation start date will be for the Asset. Additionally, determine the amount of depreciation to record on the first and last months of depreciation. Click here for full Convention Definitions. Options include:

- Full Period

- Mid Period Half

- Mid Period Full

- Next Period

4) Effective life - Enter the estimated effective fife in years and partial years (Months), as whole numbers

Accounts

1) Asset - Select the account where the current value of the Asset will be recorded and updated

2) Accumulated Depreciation - Select the account where the accumulated depreciation will be recorded and updated

3) Depreciation Expense - Select the account where the depreciation expense will be recorded and updated

4) Gain/Loss on Sale - Select the account where the gain/loss on sales will be recorded and updated

5) Potential Asset Trigger - The Potential Asset Trigger account works in conjunction with the Potential Assets List. Select the account that the Potential Asset List will monitor for any new Potential Assets in this Asset Class

Create an Asset Class

Asset Classes can be created in one of two ways: Setup Assistant or Fixed Assets sub-menu.

Via Setup Assistant

Asset Classes can be created manually, one by one, or several at once through the use of a template.

- Single - Manual

- Click the 'Add Asset Class' and complete each field to create a single Asset Class.

- Click the 'Add Asset Class' and complete each field to create a single Asset Class.

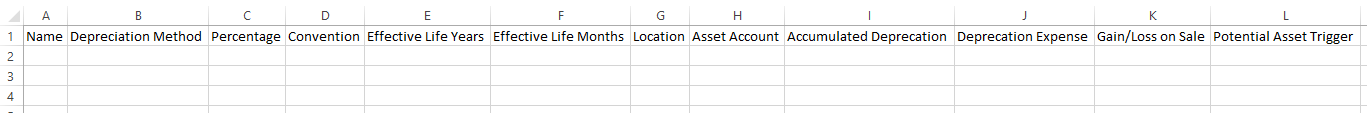

- Multiple - Template

- Click 'Export Template' to download the Asset Class Template.

- Complete the template in Excel and then save the Template. Make note of where you save the file as you will need to browse there to select and import it.

- Note: GL Accounts, Locations, Depreciation Method, and Conventions must be entered exactly as they appear in R365. If the spelling does not match, the import will fail

- Note: GL Accounts, Locations, Depreciation Method, and Conventions must be entered exactly as they appear in R365. If the spelling does not match, the import will fail

Next, click 'Import' to select and import you Asset Classes.

- Click 'Export Template' to download the Asset Class Template.

Via Fixed Assets Sub-Menu

Hover over 'Account' on the top ribbon and then the 'Fixed Assets' sub-menu. Click on 'New Class' to open the Asset Class form and create a new Asset Class.

Assign an Asset Class

Once you have created your Asset Classes, they will be available to be selected on the Asset record. The Asset Class field is a required field on the Asset record. Select the Asset Class in the Asset Class selector.

Asset Class List

All existing Asset Classes will be listed in the 'Asset Classes' list in the 'Fixed Assets' subsection of the Accounting module.