This article is part of the Fixed Assets Module training. Click here for more information on the Fixed Assets module. Specifically, Depreciation Methods are set on the Asset Class, as well as on the Asset record.

Through the Asset Class or Asset record, the Deprecation Method is assigned to the Asset. Important aspects to note include the following:

- Each Depreciation record will be created with a status of 'Unposted' once the Asset has been 'Placed in Service'

- One Depreciation record will be created for each Period and each Book for the Effective Life of the Asset

- For example, if an Asset had 13 periods of Depreciation and was utilizing three Active Books, a total of 39 Depreciation records would be created (3 * 13)

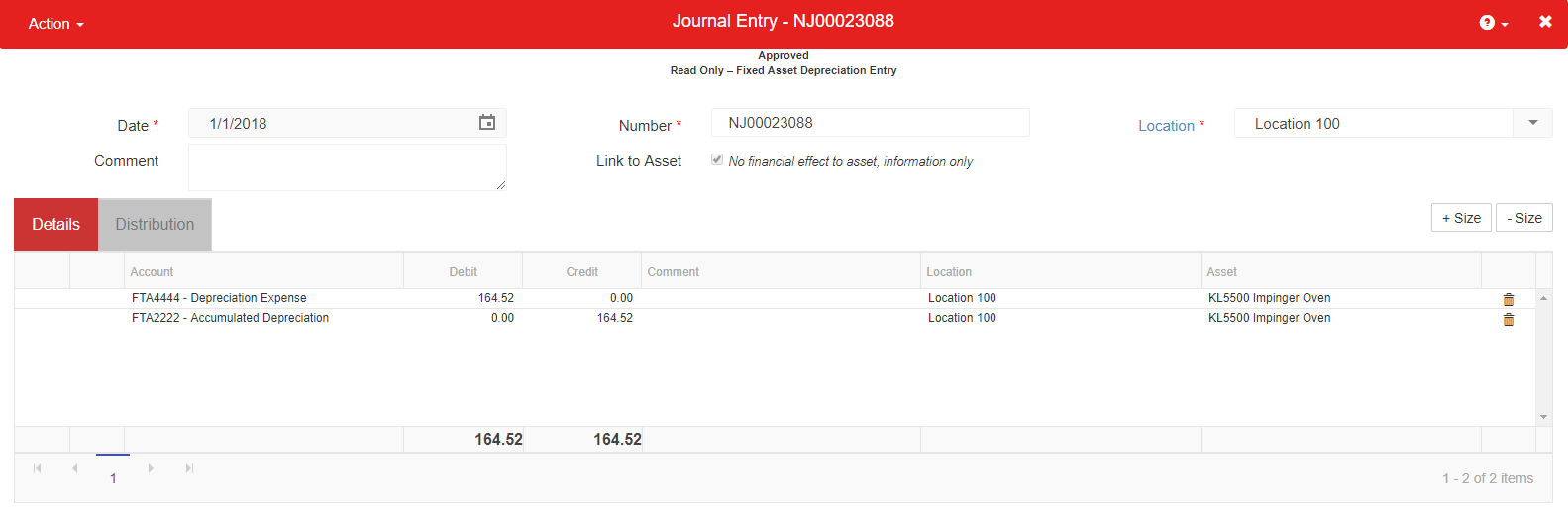

- Each Depreciation record will Debit the 'Depreciation Expense' Account for the Asset and Credit the 'Accumulated Depreciation' Account

- These Accounts are set on the Asset Class or assigned on the 'General tab' of the Asset record.

Depreciation Methods:

- Straight Line - Asset Depreciation that results in the same equal amount of depreciation expense for each Period over the Effective Life of the Asset (with a possible amount variation in the final posting)

- None - No Depreciation records will be created, Asset will have no financial value