The vendor record is where specific information related to a vendor resides in the system. Enter all necessary details as they pertain to each vendor. Vendors can also be organized into vendor groups for filtering purposes on the Payment Run screen.

Important Note: Once a vendor group has been created, it cannot be edited or deleted. Therefore, ensure that vendor names and groupings are accurate before creating a group.

Article Topics

- Accessing Vendors

- General tab

- Vendor Additional Info Tab

- Open Transactions Tab

- All Transactions Tab

- Contacts Tab

- Locations Tab

- 1099 Tab

- GL Accounts Tab

- Attachments

Navigation

To add a new vendor,

| To view or edit an existing vendor,

|

|  |

General tab

The General tab is where general vendor information and settings are managed.

| Field | Description | |

| Name | Common name for the vendor. |

| Number | The identification number used by your organization to reference the vendor or any other value used to sort or identify vendors. |

| Primary Contact | The primary contact for this vendor. Note: This field is required for vendors who will be paid using R365 Payments. |

| Comment | An open text field to be used for any purpose. The values in this comment box appear on the Vendor list and can be used to sort the list. |

| Phone | Phone number for the primary contact. Note: Phone numbers may contain numbers, dashes, parentheses, or spaces. |

| The primary email address to which purchase orders are emailed. Note: Only one email address can be entered here. Configure a list of email addresses on the Location tab to send purchase orders to all multiple recipients. | |

| Fax | Fax number, if applicable. |

| Payment Terms | Payment terms to be applied to the vendor. |

| Terms Discount Account | For payment terms that result in a discount, specify the GL account to which the discounts post. |

| Inactive | If your organization no longer does business with a vendor but has recorded transactions, the vendor record cannot be deleted. Flag the vendor as Inactive by selecting this checkbox. The vendor can no longer be selected in other areas of the software. |

| Payment Hold | If selected, the vendor is put on hold from being paid. Once this checkbox is selected, the following will occur:

|

| Address | Mailing address for the vendor. Address information appears on printed checks for mailing purposes. Note: If the vendor is paid using R365 Payments, this field is required, and only US states are accepted in the State field. Note: Ensure that the zip code does not include a four-digit extension and that no special characters are used in the address fields (.,:;#@-*). When using R365 Payments, the payments will auto-fail if they contain either of these errors. |

Vendor Additional Info tab

The Vendor Additional Info tab contains payment details for the vendor.

| Field | Description | |

| Check Name | The vendor name as it appears when printed on a check from within Restaurant365. This field is automatically populated based on the Name field in the General tab. Note: If a user wants to change the name of this vendor after it was previously created and saved, a warning message appears and asks if the Vendor Name should match the Payment Name, as shown in the image below.

|

| External Vendor Identifier | A reference number provided to your organization by the vendor that is used by the vendor to identify your organization. |

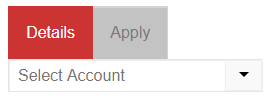

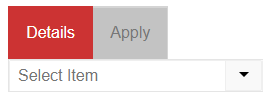

| Entry | The method by which invoices are entered into the software. The majority of vendors are invoiced by account while Food & Beverage vendors are often invoiced by item.

|

| Default Check Memo | Enter a check memo in the text field to automatically populate the Check Memo field when performing a payment run. |

| Payment Method | Method by which the vendor will be paid when performing a payment run or when using Pay Bill features. Default: Check.

|

| Entry Instructions | Enter detailed entry instructions to display when a user enters an invoice, as shown in the image below: |

| Vendor Group | Vendor group to which the vendor is assigned. |

| Bank information | If the Payment Method is ACH, enter the bank account information for the vendor, including:

Organizations with the R365 Paymentsservice enabled will also have the following field:

Note: Only users with the following permission can edit this field:

|

| Payment Per Invoice | If selected, the vendor needs a separate AP payment record for each payment created. On a payment run, when multiple invoices are paid for the same vendor, a single AP payment is created that lists each invoice. If selected, a separate AP payment and check are created for each payment. |

| Vendor Priority | The priority status assigned to the vendor, which determines the priority field on the invoice. Vendor priorities assist in identifying and prioritizing the payments on a payment run that should be processed first to optimize cash flow. |

| Short Pay | This setting has specific uses for the restaurant industry and is used to control the way certain vendors handle credits and shortages on deliveries. A Short Pay vendor is one who only requires payment for goods and services actually delivered. This is likely most of your vendors.

|

| Default Expense Account | If a Default Expense Account is selected, when entering in invoices for the vendor, the Expense Account field automatically populates with the selected default expense account. The value is not locked and can be changed as needed on the Invoice screen. |

| Use Tax | Select the checkbox to indicate that the vendor is a Use Tax vendor. Certain reports, such as Purchases by Vendor or Business Analytics (Ad Hoc Reports) can be configured to display totals for Use Tax vendors. |

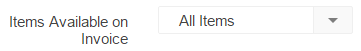

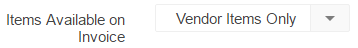

| Items Available on Invoice | For vendors with vendor items configured in Restaurant365, determine which items are available to select when entering invoices.

|

| Restricted Access - usage | If selected, Restaurant Managers cannot create transactions for this vendor but can view the transactions in the AP Transactions list. |

| PO File Format | File format used when exporting purchase orders. Options include:

|

| Fintech Integration Credit Processing | If a customer of Fintech, this selection enables the user to select how R365 will process refunds from Fintech. There are two options to choose from:

|

| Invoice Date | Source of the invoice dates for this vendor. Users can select from either of the following:

Read more about the invoice date for linked purchased orders. |

| Additional fields when R365 Payments is enabled Click here for more information. | ||

| Exclude from R365 Payments | If selected, the vendor is excluded from R365 Payments. Selecting this checkbox removes the requirement to complete certain fields for R365 Payments on the General tab. | |

| Additional fields when EDI Vendor Integration is enabled Click here for more information. | ||

| Food Service Distributor | The food service distributor that receives the purchase order. Note: Only the vendors listed in the Vendor Integration List are currently available for outbound EDI integration. | |

| Distributor Division | The specific division of the company that will fulfill the order. Note: If the selected food service distributor does not have any divisions, this field does not appear. | |

Open Transactions Tab

Any open transactions associated with the vendor appear in this list view. Transactions that are past due or within ten days of being due are marked as Past Due or Due Soon, respectively, next to the due date.

All Transactions Tab

All transactions associated with the vendor appear in this list.

Contacts Tab

Any contacts associated with the vendor appear in this list.

Locations Tab

By default, vendors are accessible to all locations, but if needed, vendors can be limited to specific locations. If a vendor is limited to specific locations, then the vendor is only available for transactions if the transaction location matches one of the vendor's locations.

Vendor location numbers can be added for each location, as needed, for use in EDI Vendor Integrations.

Vendor account numbers can be printed on Check Remittances.

Limiting a vendor to specified locations

- On the Vendor form, select the Location tab.

By default, the Available/Same All Locations checkbox is selected and the Location table is hidden, meaning that this vendor can be accessed by all locations. - To assign specific locations, uncheck Available/Same All Locations.

The Location selector and Locations table appear. - In the Select Location lookup field, enter the name of a location or select a location from the drop-down menu.

- Select Add to add the location to the table.

- Add the location-specific Email (used for Purchase Orders) and Vendor Location Number (used for EDI Vendor Integrations).

- Note: Multiple email addresses can be configured by separating each email address with a semicolon ( ; ).

- Repeat these steps until all desired locations are added.

- Note: Ensure that all locations (even locations that will not be used in Purchase Orders or EDI Vendor Integrations) that will use this vendor for AP invoices / AP credit memos are added to this table, otherwise they will not be able to use or select this vendor during invoice entry.

- Save your changes.

Printing Vendor Account Number on Check Remittances

The vendor account number can be printed as part of check remittances:

- Select the Print Vendor Account Number on remittance checkbox.

- Note: This option only appears if the Available/Same All Locations option is unchecked.

- Enter the Vendor Account Number for each applicable location.

- Save your changes.

When checks are printed, the vendor account number for the location will be printed as the customer number.

1099 Tab

The 1099 tab is where all 1099 information is configured for the vendor. To learn how to update this information after it is initially saved, see Update 1099 Vendor Types.

| Field | Description | |

| Name | Common name for the vendor. This field is automatically populated based on the Name field in the General tab and is read-only. |

| Check Name | The vendor name as it appears when printed on a check from within Restaurant365. This field is automatically populated based on the Name field in the General tab and is read-only. |

| Exclude when processing 1099s | If selected, the vendor is excluded during 1099 processing. |

| 1009 Type Information | Select whether the vendor is a company or an individual. The following additional fields appear based on your selection:

|

| Active | Select the checkbox to mark the corresponding form as Active, or in use, for the vendor. Note: Marking a form as Inactive will update all unapproved transactions that use this form and box to the next defaulted form/box. If no other forms are active, the 1099 information is removed from those transactions. |

| Default | The default form for the vendor, which will appear on the data entry screen (AP Transactions). Only one form can be marked as the default form, and if the default form is marked as Inactive, then the first active form will be set as the default. Note: The default form can be updated at any time. |

| Form | The available 1099 forms for the vendor, which include:

|

| Box | A default box selection will need to be made for the form(s) selected. Options include:

|

| Allow Box Override | If selected, the user can select a box other than the one selected on the vendor record when entering transactions. |

| Upload File | Upload a file to attach to the record. |

For more information on 1099, view the 1099 Setup and Maintenance training article.

Multiple columns can be added to the vendors list in regards to 1099 information. To add a column, simply click the Show/Hide Columns selector and select the checkbox next to the desired columns. Click here to learn more about working with lists.

GL Accounts Tab

This tab allows users to map GL accounts in R365 to the GL account numbers provided by the vendor. Only vendors who utilize DataPass need to have GL accounts mapped. Mapping these accounts will then automatically set up AP invoices brought in through FTP as Entry by Account in R365.

Note: If no mappings are found for a GL account, an error occurs. Users must set up the necessary mappings so that data can be imported.

Users can map GL accounts in two ways:

- Manually - Users with the necessary security access should navigate to this tab, select the desired GL account in R365, and then enter in the vendor's GL account number for that selected GL account. Select Add to include the account mapping for this vendor. After adding all necessary mappings, ensure to save the vendor record.

- Import Tool - Users can enter in the desired GL accounts for a vendor using the Import Tool, which is efficient for adding a large number of GL accounts to a vendor record. To do this, navigate to the Import Tool, select Vendor GL Account Mapping for Options, and then select one of the following options in the Type field:

- Create New - Use this when adding new GL accounts to a vendor record.

- Update Existing - Use this when updating a vendor account number.

Attachments

Some vendors may have contracts or buying agreements. These and any other vendor-specific documents you wish to keep readily accessible can be added to the vendor record in Restaurant365. Do this by clicking on the Upload File button found on each tab. Click here for more information on Uploading Files.