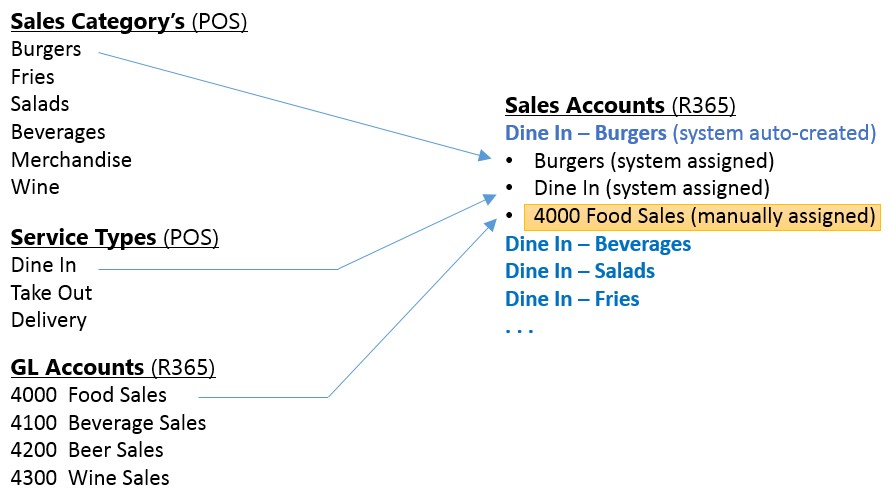

A Sales Account's purpose is to tell Restaurant365 what GL Account to credit when accounting for individual sales tickets imported from the POS. It is a 'mapping' of POS Sales Categories and POS Service Types to a Restaurant365 General Leger Account.

Note: POS Account Rules can be set up to map new and unmapped Sales Accounts brought in from the POS. Click here to learn about POS Account Rules.

The Restaurant365 POS integration automatically creates unique Sales Account records (in R365) for every combination of Sales Category and Service Type from sales tickets imported from the POS to R365. Each of these Sales Accounts must be manually mapped to a GL Account during setup (as highlighted in yellow above.)

The full list of Sales Accounts created from the integration with your POS can be seen in the Sales Accounts list. Navigate to the Accounting/Operations Module, Administration subsection and select 'Sales Accounts' to load the list.

Sales Account Record

1) Category - This is the sales category imported from your POS system. It is auto-assigned to the Sales Account when the POS import is first run. Do not edit or change this value

2) Service Type - This is the Service Type imported from your POS system. It is auto-assigned to the Sales Account when the POS import is first run. Do not edit or change this value

3) Sales Account Type - The Sales Account Type is used to tell the system how to account for each Sales Account. There are a variety of line items on POS transactions that require a 'Credit' other than menu items that you sell. The Sales Account Type is used to identify these

- Standard (none) - This should be selected for all Sales Accounts unless they specifically belong to one of the other Types

- Catering Deposit - This is used for money received from a customer as a deposit for a catering job. Typically, the GL Account you would want to assign to this Type of Sales Account would be "Catering Deposits" - a liability account to track the amount of money received for services you have not yet performed. (After the event was delivered, you would issue an invoice to the customer and debit 'Catering Deposits' and credit "Catering Sales" - a revenue account

- Catering Item - This is used for items setup in your POS system that are used for selling catering events/jobs. They might be generic or specific in nature. Typically, the GL Account you would want to assign to this type of Sales Account would be "Catering Sales" - a revenue account

- Tip - This is used for amounts recorded in your POS system as 'tips' from customers for your staff. Money collected by from your customers on behalf of your staff is a liability to your company. The typical GL Account for these Sales Accounts would be 'Tips Payable' - a liability account

- Tax - This is used for amounts recorded in your POS system as 'tax' from Sales Tickets. Different Sales Accounts can be created with 'Tax' as the Sales Account Type

- Cash Refund - This is used for transactions that you enter in your POS system to refund money to your customers. Typically, the GL Account assigned to these Sales Accounts is the same GL Account you assigned to the Payment Type Account used for recording the collecting of 'Cash' from customers (i.e. the Payment Type Account with the Payment Group of 'Cash' as shown below). Typically, the account is either an Un-deposited Funds asset account or a cash account directly

- House Account Payment - This is used for transactions recorded in your POS system that record the receipt of money from 'House Account' customers (i.e. you invoice your customer via an invoice and then the customer walks into your restaurant and pays the invoice at the counter by giving you their credit card.)

- Gift Card - This is used to map Sales money to gift cards

4) GL Account - This is selected manually on each Sales Account

- Note: All amounts booked to the GL Accounts from Sales Accounts will be credits on the Daily Sales Summary Journal Entry

Assigning Sales Accounts on an Ongoing Basis

After the initial setup, and all the Sales Accounts have been created and mapped to GL Accounts, there are occasions where new items are setup in the POS system. On the day these are used in the POS system, the Restaurant365 integration will pick these up and auto-create a new Sales Account that will need to be assigned a GL Account and flagged with the proper Sales Account Type.

- Using the 'Sales Accounts' List - any Sales Account missing a GL Account assignment

- The Accounting To-Do List Dashboard displays a list of any Sales Accounts missing a GL Account

- On the Journal Entry tab of each Daily Sales Summary transaction, there is an 'Assign' button whenever a Sales Account associated with that day is missing a GL Account. The Sales Account Setup screen can be accessed directly from the Daily Sales Summary record by clicking on the 'Assign' button highlighted below. This makes it easy to quickly assign the GL Account and then Approve the Daily Sales Summary transaction.