Restaurant365′s Chart of Accounts comes with pre-defined ‘GL Types’ specific to the restaurant industry. They are:

- Current Asset

- Fixed Asset

- Other Asset

- Current Liability

- Long Term Liability

- Equity

- Sales

- COGS or Prime Cost

- Labor Cost

- Operating Expense

- Non Controllable Expense

- Corporate Overhead & Other

- Income Tax

Click here for more information on GL Types.

It is required that each of your GL Accounts be assigned to one of these GL Types. Restaurant365′s out-of-the-box financial reports group your accounts by GL Type first, then by Parent Account, then by Account Number.

Reviewing Reports

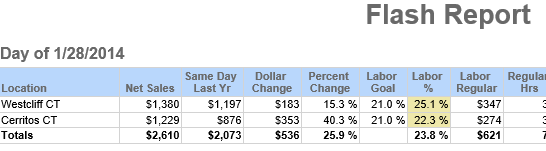

On all the non-Profit & Loss reports, Restaurant365 labels the summation of all GL Accounts assigned to the GL Type of ‘Sales’ as “Net Sales”

An example of this is seen below:

The system assumes that you have assigned not only your revenue accounts to the GL Type of ‘Sales’ but that you have also assigned your Discounts & Comps account(s) to the GL Type of ‘Sales’ as well. Thus, on all the non-Profit & Loss reports, it is summing these together to display your Net Sales. The system uses this number to calculate other %’s and values.

Although the wording in the non-Profit & Loss reports is hard coded to read ‘Net Sales’, there are many organizations that will want that number to be their actual Gross Sales. Those organizations should classify their Discount & Comps account(s) to the GL Type of something other than ‘Sales’. By doing so, the number displayed on non-Profit & Loss reports will actually be their Gross Sales even though it will still display as ‘Net Sales’ on the report.

- Note: Restaurant365 Report Roles can be configured to restrict a User's view of the Profit & Loss reports to only controllable dollars. The 'P&L Cutoff' setting for Report Roles can be set to limit these reports to only include data for GL Accounts assigned to the GL Types of Sales, Prime Costs, and Operating Expense.