Conditions in which UNASSIGNED VENDOR appears on AP Aging Report

The UNASSIGNED VENDOR is a system-generated Vendor that appears on the AP Aging report when the following conditions occur.

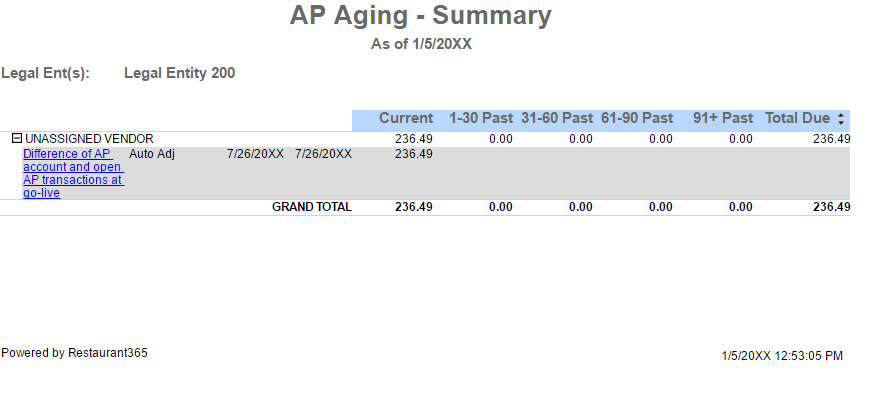

Difference in AP Beginning Balance and Imported AP Invoices at Cut Over

A difference exists between the AP Beginning Balance (the opening balance for the Accounts Payable GL Account) and the sum of all imported Open AP Invoices Beginning Balance transactions (AP Invoice - Beginning Balance transactions that were imported at cut-over). In addition to appearing on the AP Aging report, the 'System Setup' tab will be present in the 'To Do Checklist' notifying the User that the AP Beginning Balance does not equal the sum of Open AP at cut-over as shown below:

Journal Entry Coded to Accounts Payable

A Journal Entry (non-beginning balance) directly codes a dollar amount to the Accounts Payable GL Account. Coding directly to AP is not recommended as the amount will never be removed from the AP Aging Report. Any AP transactions that need to be recorded in Restaurant365 should only be entered via the AP Invoice, AP Payment, and AP Credit Memo transaction types

Removing Values from the UNASSIGNED VENDOR

UNASSIGNED VENDOR should not remain in Restaurant365 and acts as a placeholder. In each scenario above, the necessary steps to remove any balance from the UNASSIGNED VENDOR need to be taken as soon as possible for an accurate AP Aging. If Journal Entries continue to post directly to Accounts Payable, their respective balance will reside on the AP Aging report indefinitely. The process for fixing each condition is detailed below.

Difference in AP Beginning Balance and Imported AP Invoices at Cut Over

The User adjusts the AP Beginning Balance. The required adjustment will depend on the sign of the 'Auto Adj' value on the UNASSIGNED VENDOR.

- If the 'Auto Adj' value is Negative (negative sign in front of the value), the required adjustment will be one of the following:

- Adjust the existing GL Account Beginning Balance Journal Entry until the GL Beginning Balance is equal to the Open AP Beginning Balance

- Delete the excess/offending Open AP Beginning Balance Transactions until the values are in balance

- If the 'Auto Adj' value is Positive (no negative sign in front of the value), a User would need to add additional Beginning Balance AP Invoice Transaction(s) until the values are in balance

Users can create new Beginning Balance Journal Entries and new Beginning Balance AP Invoice Transactions via the 'Administration' menu in the top ribbon in Restaurant365 as shown below:

Journal Entry Coded to Accounts Payable

The User unapproves and deletes the Journal Entries that contain the Accounts Payable GL Account and replaces them with AP Invoice Transactions